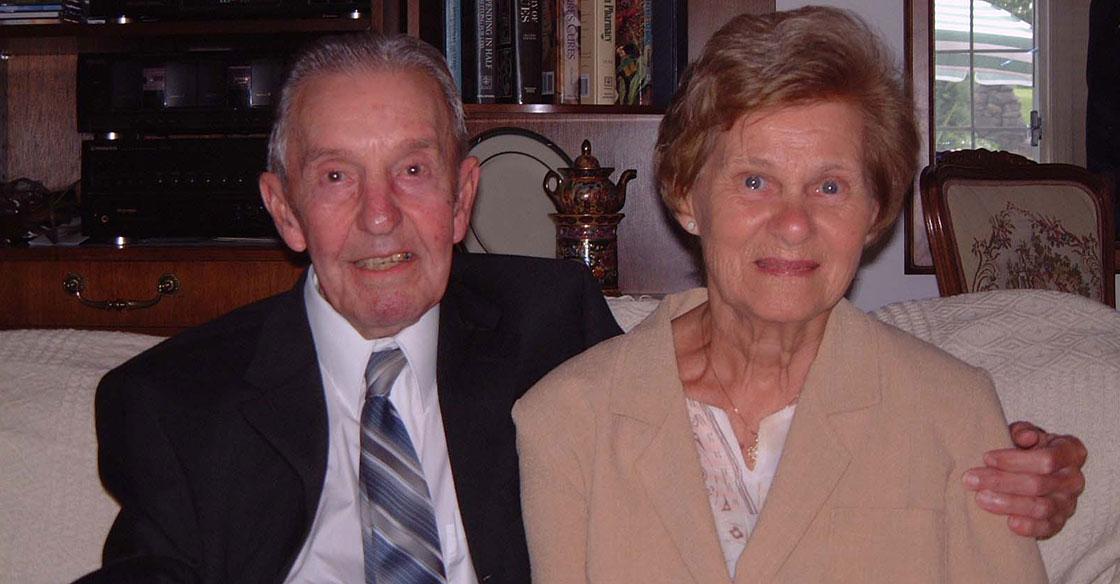

Originally published by the Chronicle Herald. Beryl Claus (right) pictured with her late husband, Hugh. Beryl has donated more than $100,000 to the QEII Foundation – all via gifts of securities – in support of QEII veterans’ care and the Veterans’ Memorial Garden.

Care for Canada’s veterans has always held a special place in Beryl Claus’ heart. Her late husband, Hugh, and three of her brothers were all veterans. Her brothers, James and Malcolm, resided at the QEII Camp Hill Veterans’ Memorial Building near the end of their life.

“Those healthcare teams have taken great care of several family members, as has the QEII hospital itself,” Claus says. “Camp Hill is a place I will always support.”

When Claus and her daughter sat down with their financial advisor, they learned about supporting charities with donations of securities. That knowledge then sparked a yearly tradition for the now 99-year-old Claus.

“She now donates securities every year and it’s something my father would be incredibly proud of,” says her daughter, Tanya. “Supporting charities and giving back – whether through donations or volunteering – is really important to mom and our family.”

Last year, Claus’ annual gift of securities helped to fund the multi-purpose activity court in the QEII Veterans’ Memorial Garden, where residents and their families can play bocce ball and enjoy other outdoor activities. It’s a prime example of how your investment can have an immediate and meaningful impact on the lives of those receiving care at the QEII.

Donating publicly-listed securities – such as stocks, bonds and mutual funds traded on approved stock exchanges – is an effective way to support important causes, like health care, and an efficient tax strategy.

Rick Irwin, a Certified Financial Planner with Trinity Wealth Partners, has worked with many clients over the years, helping them tailor their charitable giving to provide optimal tax advantage.

“It’s very generous to give cash, and you get a charitable tax receipt,” Irwin says. “But when you donate securities that have appreciated in value, the capital gains tax is eliminated. So it’s a win-win for clients.”

To qualify for the capital gains exemption, the securities must be transferred in-kind to the recipient charity, rather than being sold with the proceeds then donated. The elimination of capital gains also applies to gifts of securities in a will.

Many elderly investors have investments that have been in their portfolio for decades and have realized significant appreciation over those years. Irwin will sit down with clients and review their portfolios to identify the assets that will provide the best tax advantage to the donor.

Irwin has also observed an increase in charitable giving over the past two years, as the pandemic has caused people to re-think their priorities in life and focus on the things that really matter.

“I’ve seen clients become more introspective, and considerate of the things that are really important in their lives,” he says. “In many cases that leads to an increase in charitable giving.”

When an individual gives a gift of securities to the QEII Foundation, they can designate their donation to an area of care or research that is meaningful to them, or choose to support an area of greatest need.

“Giving gifts of securities has become increasingly popular over the last several years,” says Geoff Graham, Charitable Giving Advisor with the QEII Foundation. “The stock market has been doing well, and our supporters are seeing the advantages of this approach to supporting health care.”

Donors to the QEII Foundation can direct their gifts to a range of care areas, from cancer care, heart health, mental health programs, and surgical innovations to the QEII Foundation’s Diversity in Health Care Bursary program. The process is made simple for donors, with a form available on the QEII Foundation’s website.

“You fill out the form and give it to your broker, and that puts the wheels in motion,” Graham explains.

Many donors will leave charitable gifts in their will, and that certainly leaves an important legacy. But there is also great joy that comes with witnessing the difference your donation makes, Graham points out.

“Many donors will choose to do both,” he says. “As a donor you can see the impact of your gift while you are living, then you can make a donation in your will as a way to extend your legacy.”

Though Claus is no longer in Nova Scotia, she is proud to be a supporter of the QEII Health Sciences Centre and plans to continue donating.

“It feels good to put that investment into health care and make an impact,” she says. “I’m happy to do it.”

To learn more about giving a gift of securities and to support health care at the QEII today, visit QE2Foundation.ca/securities.